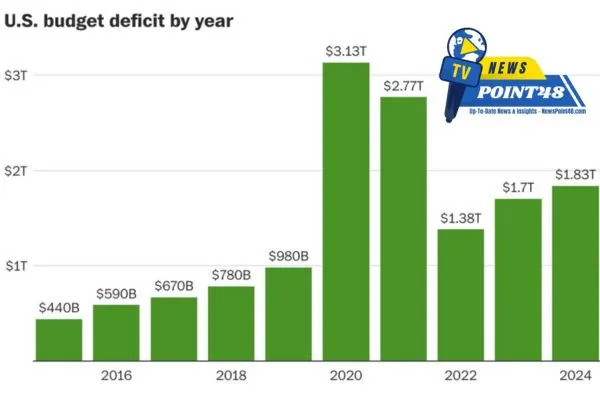

US Budget Gap Hits $1.8 Trillion As Interest Payments Rise. New figures estimate the US will run a massive $1.8 trillion shortfall this year as interest costs on the national debt mount. This is a concerning number, and a more immediate reflection of the federal fiscal challenges to come Implications for Fiscal Policy, and Economic Stability

Understanding the Deficit

When a government spends more money than it takes in from taxation, this is known as a budget deficit. America’s deficit has been a worry for decades, but the recent sprint to $1.8 trillion has sparked debates on government spending, tax policy, and the broader economic horizon.

The growing immediate deficit results not only from more spending but also from the dollar cost of servicing the national debt. As interest rates increase, the expenses needed to pay those obligations also increase. This will be especially true for interest payments on the national debt, which are projected to eat up an increasing percentage of the federal budget, diverting resources from other critical areas like education, infrastructure, and social programs (CBO). (US Budget Gap Hits $1.8 Trillion As Interest Payments Rise)

Causes of the Shortfall

There are a few key reasons for the larger deficits today:

Higher Interest Rates: In response to inflation, the Federal Reserve has acted to raise interest rates that also serve as a barometer for the government’s borrowing cost with the price typically rising as rates climb. Rising interest rates also make it more expensive to service the already enormous debt pile, adding further stress to public finances.

Higher Spending:The COVID-19 crisis led to historically high expenditures, on public health measures and economic support for individuals and businesses. Certainly, most of these measures were necessary, but they also caused a dramatic increase in the US national debt.

Bottom Line: US government revenues have fallen short of what were supposedly robust projections, not least in part because imploding oil prices are hitting federal income hard. This drop in revenue added further to the deficit.

Entitlement Programs: In the wake of an aging population and rising healthcare costs, entitlement programs, like Social Security & Medicare present an ever-growing bill for taxpayers. Much of the federal spending and deficit is attributable to these programs.

The Economic Impact

There are broad implications to the U.S. economy of a ballooning budget deficit. Economists caution that persistent large deficits can ultimately have two very bad possible consequences:

Higher Interest Rates:As the government borrows to cover the gap, higher interest rates may send borrowing costs up throughout the economy. Higher borrowing costs can tamp down economic growth, as businesses and consumers pay more to get loans and credit — although historically low interest rates have minimized that effect.

Inflationary Pressures: Persistent deficits can lead to inflation, especially if it is financed by printing money. Inflation weakens buying power and can create economic instability.

Poor Fiscal Flexibility:A high deficit eats away at the government’s power to counter any future economic crisis or recession. Large interest payments on our borrowing would take away a substantial part of the budget that could have gone toward economic infrastructure and investments in education and public services.

Possible Solutions

(US Budget Gap Hits $1.8 Trillion As Interest Payments Rise). To fix the $1.8 trillion shortfall will need a raft of measures Plenty of options exist for policymakers to return the budgetto balance.

Spending Cuts: Budget items will be evaluated to look for discretionary spending that can be cut to lessen the deficit. This could then mean making some difficult decisions about what programs to focus on and what ones to say no to.

A Tax Reform: Yes tax reform to put it simply, might also be this potential solution. It may include closing loopholes, changing tax rates, or broadening the base so that everyone (both individuals and businesses) pays taxes on a similar proportion of their income.

Economic Growth: Investments in technology, education, and infrastructure are well-known to facilitate long-run economic growth which can theoretically increase revenues. A strong economy increases tax revenue over time which can bring down the deficit.

Entitlement Programs: The long-term solvency of entitlement programs must be addressed. These programs will be bankrupt soon and policymakers may need to develop structural reforms to make sure the programs are still around for future generations without putting an unbearable burden on their children on grandchildren.

The Path Ahead

The $1.8 trillion deficit that the U.S. is facing will give policymakers and the economy as a whole big headache going forward this year. As interest costs go up along with increased spending and declining revenues, this provides a maze of conflicting signals that need to be addressed now and seriously. (US Budget Gap Hits $1.8 Trillion As Interest Payments Rise)

While the dialogue about fiscal policy at nespoint48 takes place, all parties must be talking to each other to deal with the real issues that give rise to these deficits. Ensuring a strong and sustainable economic future for all Americans will require carefully balancing the nation´s immediate relief needs against its long-term fiscal responsibilities.

US Budget Gap Hits $1.8 Trillion As Interest Payments Rise. Else the latest updates on the U.S. economy and fiscal policies do follow Newspoint48 for In-depth coverage with analysis. Keep up with how these changes will change your financial future and the economic landscape.